2024 Georgia USDA Loan Conditions

Homeowners considering to buy a property inside Georgia’s rural groups you will definitely provides 100% No advance payment financial solutions thanks to the USDA outlying houses mortgage.

The nice development is actually much of GA away from instantaneous area off Atlanta, Augusta, Columbus and you can Macon are likely nevertheless recognized $0 down USDA home loan. Excite understand the USDA map picture to own Georgia, the latest darker shaded components certainly are the ineligible cities. Buyers can use the brand new address lookup device to see the complete USDA chart right here.

USDA financing are especially an effective system for very first-date home buyers with absolutely nothing dollars deals some other financing software that require a deposit. However, even although you are a house consumer who’s step 3% or 5% or 10% to possess a downpayment, you’ll be able to however need a closer look within USDA loan. As to why? the most affordable month-to-month mortgage insurance premiums!

The latest month-to-month financial insurance coverage (PMI as most learn) which have a USDA mortgage loans Kirk is significantly less a month in contrast so you’re able to FHA or old-fashioned money.

New USDA financing even allows your house merchant to spend every new consumer’s settlement costs, causing absolutely nothing so you’re able to zero away-of-pocket-money in the home buyer. The main challenge in order to homeownership are down payment, particularly for Georgia’s basic-time home owners. Towards the 100% USDA mortgage, homeownership remains you’ll be able to.

Tips Look at the USDA Qualifications?

- Basic, the house need to be based in good USDA eligible urban area. Once more, a lot of Georgia external biggest metropolises is approved for the program. If you learn your local area isnt eligible, delight contact us to go over more lowest-downpayment alternatives instance an FHA home loan.

- 2nd, the family income need to be underneath the lay limits which might be in position for each county. Follow this link for lots more home elevators 2024-2025 USDA income restrictions when you look at the Georgia.

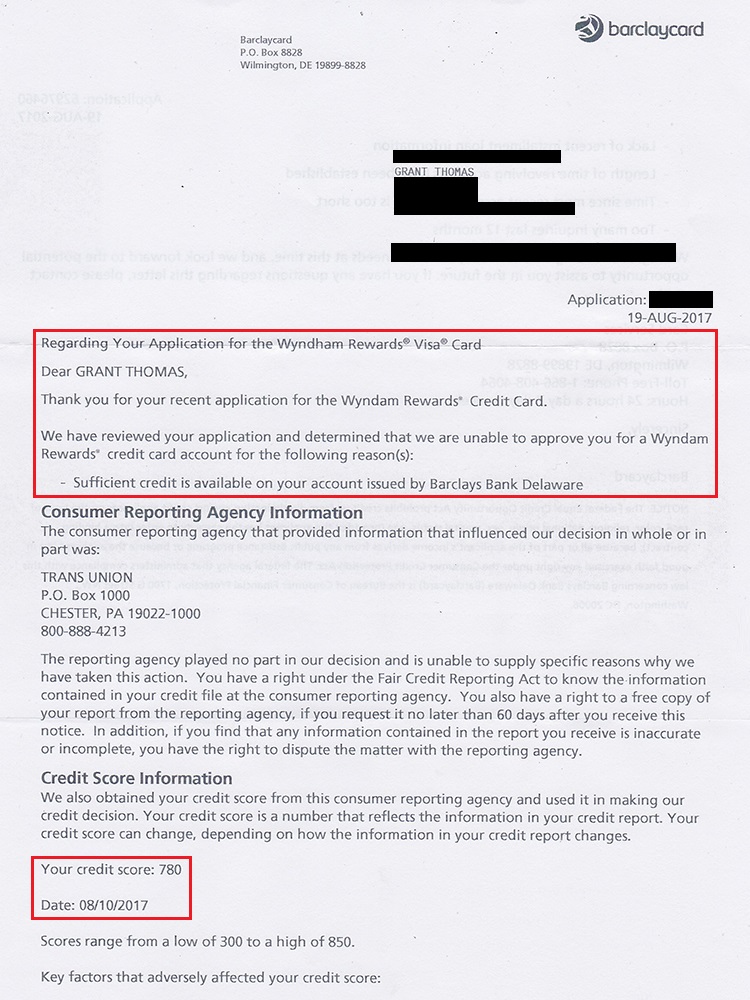

- USDA credit rating certification: 620 and you can a lot more than credit score will become necessary by the really loan providers when financing 100%. A lot more standards can get sign up for people home buyers having got early in the day borrowing from the bank adversity such as bankruptcy, quick revenue, foreclosure, an such like

- Financial obligation to income rates (DTI): Lenders needs a look at your own houses and you can full debt-to-income proportion. The brand new PITI (home loan prominent, appeal, fees and homeowners insurance) have to be less than 30 percent of your monthly income. All the more monthly obligations is going to be no more than 42 percent of income. These limitations will be quite exceeded, possibly which have solid compensating points (large fico scores, etc)

- Employment Background: Essentially a substantial several-seasons background required. Today, this does not should be with the exact same manager, simply much more continuous It rule does not affect current school students. Homeowners which have prolonged openings within their a position can be recognized that have right records describing the brand new gap (medical grounds, etc.)

Customers would be to remember that USDA Outlying Invention now offers a couple of different kinds away from financial software. New USDA lead program as well as the 502 Secured system. The fresh new USDA lead system is actually canned individually by the USDA.

The fresh 502 Protected program is actually canned merely because of the acknowledged loan providers and banks. More often than not, lower-money individuals uses new head system. Average income property use the 502 Secured system. This new USDA 502 system makes up about the large most USDA casing mortgages.

USDA has the benefit of of a lot re-finance choices for property owners you to definitely currently have a beneficial USDA financing. USDA interest rates keeps fell when you look at the present weeks, and you can residents one to acquired an effective USDA over the last very long time line re-finance solutions.

Want to learn more about USDA Rural Homes loans? E mail us all week long by the calling the number more than, or perhaps fill out brand new brief Information Demand Function on this page.