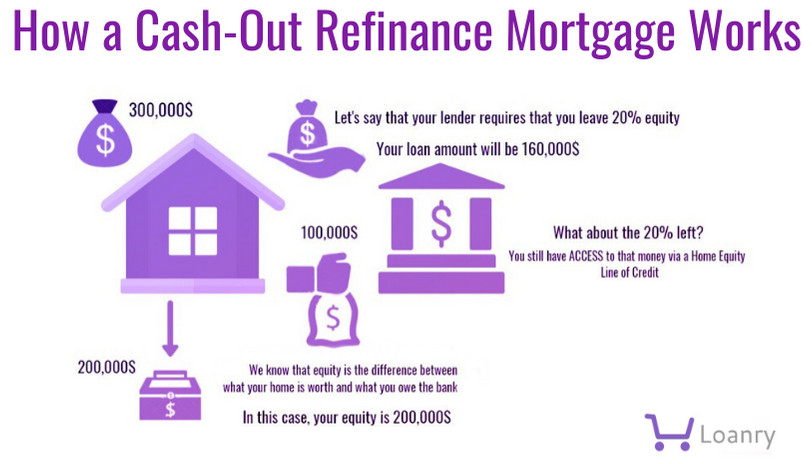

A good. One another variety of loans make use of the residence’s collateral, usually, so you can document a second lien on your own home once the security for the borrowed funds. The essential difference between both is where the bucks is given for you. A genuine Family Collateral Loan is a one-date disbursement from financing; whereas, a beneficial HELOC try a great rotating personal line of credit. Thus you can improve the cash, repay it, then use it once again in draw period of the mortgage.

Q. Exactly what can I use the fresh HELOC having?

An excellent. The fresh air ‘s the limit! You can re trips, pay for expenses, buy your child’s braces, or other shocks that will pop up!

Q. How much time can i use the revolving personal line of credit?

An excellent. This new mark period of the financing try ten (10) decades. During this time period, you could get better the brand new offered money on your HELOC as required. Just after a decade, the outstanding equilibrium turns loans Dotsero to a four- or ten-12 months cost plan. Contact one of the economic solution representatives for much more facts.

Q. What’s going to my costs be?

A. During the draw period of the loan, repayments are based on possibly a beneficial $one hundred lowest fee or step one% of your an excellent principal balance, according to the balance due. Such, if you have an effective $20,000 credit line with good $5,000 equilibrium, the commission could be $one hundred. When you yourself have that exact same line of credit having $fifteen,000 advanced, your fee is $150. Due to the fact mortgage goes in fees, the balance owed would-be divided into regular repaired monthly installments through to the mortgage is actually paid back.

Q. What type of speed can i get to possess a great HELOC?

A great. The fresh Annual percentage rate (APR) to possess an excellent HELOC was a variable speed within the mark months of loan. The rate is dependent on your credit rating and the financing-to-worthy of proportion (LTV) and can be as little as 4.00%! Debt service member are more than simply prepared to identify the details of qualifying interest rate.

Q. What kind of charge will i end up being billed?

A beneficial. One of the several positive points to belonging to NCCU was the lower fees! All of our HELOCs lack yearly charges otherwise settlement costs such as for instance a number of other creditors create. We have a one-time $199 handling percentage and is they! There are particular circumstances otherwise large mortgage numbers that would want a 3rd party provider (assessment, identity coverage, etc.) from the an added cost, however your economic services user are working with you to decide in the event that’s expected.

Q. What is the minimal and you may limit amount I can score?

A beneficial. The minimum amount to own an excellent HELOC try $ten,000; the maximum amount is set to the an incident-by-case base with respect to the count you qualify for as well as the guarantee of your home. Your financial provider representative contains the solutions!

Q. Simply how much from my home’s security must i fool around with?

A. Our very own HELOCs was priced for up to an 85% loan-to-really worth ratio (LTV). Visit your financial solution member having details! *85% LTV is true for first home just. Select a financial service user to possess facts about investment otherwise local rental services.

Q. Can you imagine I wish to make use of the equity in one of my personal funding or rental features?

Good. Then you’re in luck! We are able to assist you with one also. not, understand that rates, LTV, and you can required data files will differ from those individuals for a proprietor-filled home. See your monetary solution affiliate to have facts!

Their deals federally insured in order to at the very least $250,000 and backed by a full faith and you can borrowing from the bank of the You Regulators.

Down load The App!

If you use a screen viewer or any other additional help and generally are having trouble with this particular webpages, excite phone call 970-330-3900 having guidance. All of the services available on this amazing site come in the every Northern Texas Borrowing from the bank Partnership complete-service towns.