- The go out out-of birth

- And therefore branch your offered

- Your review

- Your schedules off productive obligations

- Selection of when lost

- Types of launch

- Are you presently eligible to return to provider

- Label and you can signature out-of commanding officer

Va Mortgage Appraisal Conditions

The Virtual assistant mortgage techniques have a few requirements that are not negotiable, referring to among them. You really need to have the house that you like to buy appraised. Also it needs to be done from the a great Va-approved appraiser. Thankfully that there’s a country-greater community of those appraisers together with Virtual assistant usually assign one toward circumstances. The not so great news is, you’re going to have to buy so it ($525 and you may $step one,five hundred, based on where you are purchasing your family).

Remember: the brand new assessment is not necessarily the just like an inspection. If you wish to understand what the newest appraiser was appearing to possess, there clearly was an inventory.

Virtual assistant Mortgage Household Evaluation

Once the appraisal processes was a requirement, the home review is not a good Va needs. It’s likely that your individual bank otherwise large financial company will need one do an inspection, but it is advisable that you remember the examination is especially indeed there so you can include your, our home consumer. Rather than the latest appraisal, a house inspector is certainly going strong into the most of the issues of your property, particularly:

- Electric

If they discover items that make the home hazardous or not-up-to code, they are going to tell you just what must be fixed. That will impact the dealings on the merchant.

This is a new city in which Family getting Heroes can help. We hook you to a system of realtors, and you will domestic inspectors are included in the team. I have inspectors nationwide one to understand the demands of army parents and you will experts. Furthermore, all the House to have Heroes inspectors make discounts available to our military heroes and then we have them structured because of the state.

Because the Va financing system doesn’t have the very least borrowing from the bank rating specifications, the non-public lenders who in fact offer the financing most likely manage. These types of mortgage brokers are apt to have at least one to range ranging from 580 and you will 620. There are some things you could do to fix your own borrowing from the bank. If you have a bankruptcy or a foreclosure on your early in the day, the brand new Virtual assistant is pretty good about giving you yet another opportunity. The fresh prepared several months having a property foreclosure is couple of years and the new waiting months for case of bankruptcy is actually anywhere between one year and two many years.

Okay, have you had the Va loan ensure and possibly you have your own mortgage as well as your new home. Are you presently over? Not if not wish to be installment loans online WV. The new Virtual assistant mortgage are a lives benefit plus it provides almost every other financing be sure services that will help you with every family your individual.

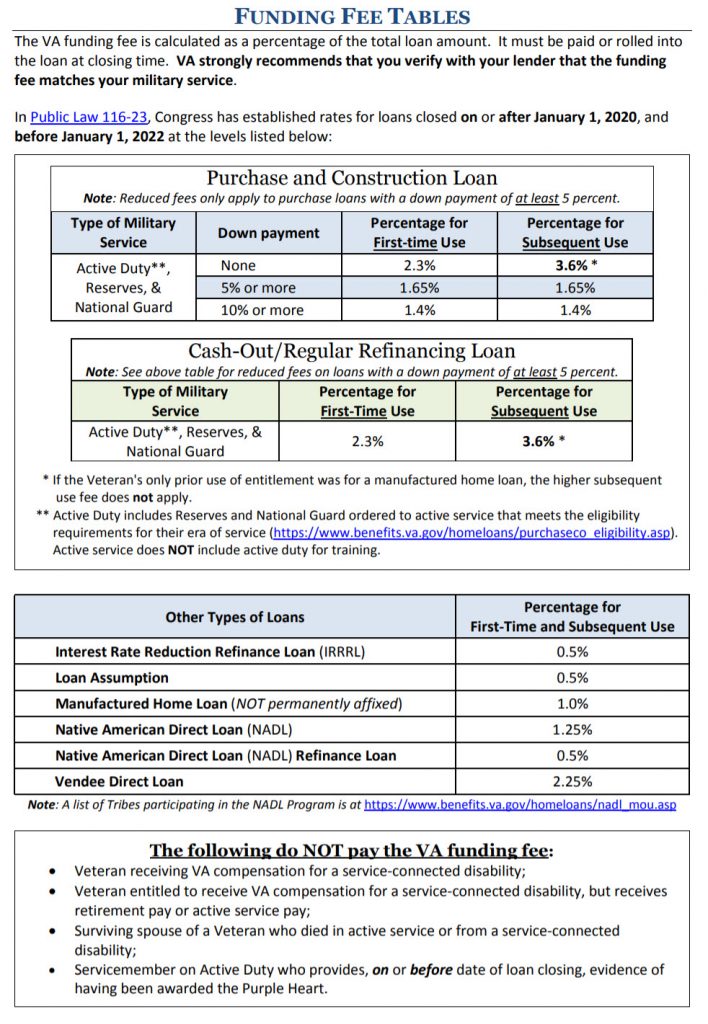

Things you should check with the is the Virtual assistant home loan refinance applications. These can assist you with the monthly funds as well as your overall financial health. They have one or two different financing promises.

Virtual assistant IRRRL: The pace Cures Refinance mortgage

The fresh Virtual assistant Interest Avoidance Refinance mortgage, or Virtual assistant IRRRL, is a sleek re-finance system that helps army experts and you may veterans rework the latest money.

New Virtual assistant IRRRL try that loan you to changes your current home loan which have yet another Va-insured mortgage, but this 1 features a lowered interest. They have you as part of the Virtual assistant Loan program, but that have a lower rate of interest provides brief-label and you will a lot of time-term benefits.

It is critical to keep in mind that the latest IRRRL Virtual assistant mortgage is just offered to the modern Virtual assistant Loan proprietors. If you have not experienced the techniques and started recognized to own (and you may obtained) a good Virtual assistant Financing, this refinance option isn’t really available to choose from. If you have a great Va Mortgage, it another analytical step for your requirements.