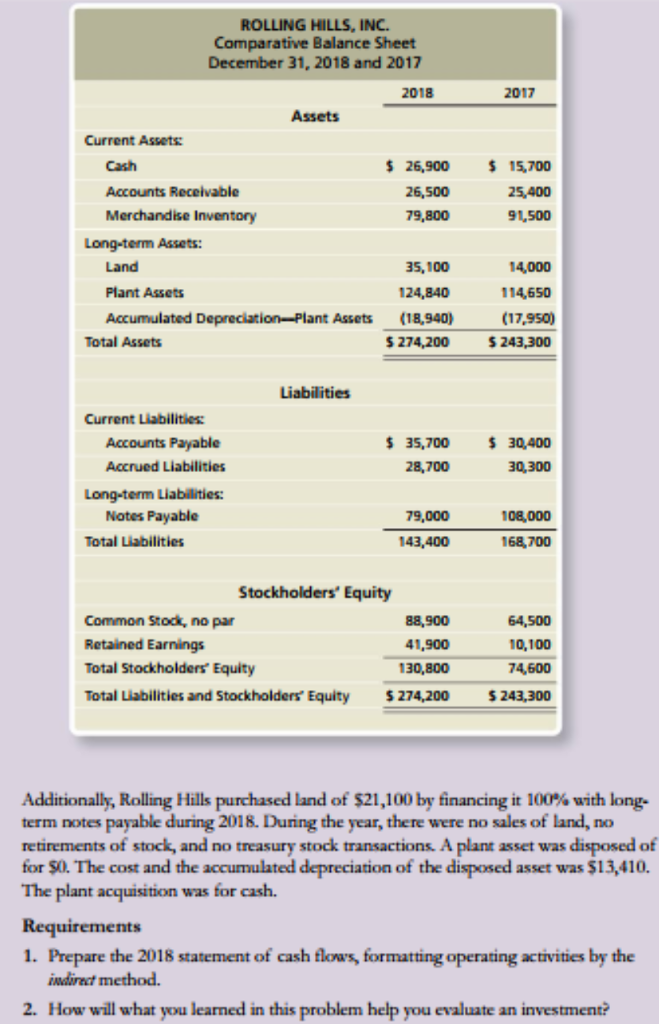

Hence, 17% off the lady $70,one hundred thousand salary is $11,900 annually. Hence, brand new max the girl mortgage repayment shall be try $991 four weeks. If in case a 30-12 months financial (Dominating and you will Notice) from the 5%, she would only be eligible for a mortgage from $185,000. After you account fully for property fees and you can homeowners insurance, you to definitely matter will be much less however.

Over We mention one Large Box Loan providers aren’t trained in college student funds. Many home loans commonly sometimes this is exactly why it could take you time and energy to find one. This is very important while the never assume all education loan preparations is managed equally when you find yourself seeking be eligible for a home loan.

So you’re able to clear up education loan preparations in the FitBUX, all of our education loan coordinators crack them down into several procedures: Pay off Tips and you may Mortgage Forgiveness Steps. It is extremely vital that you be aware of the differences between the two as they have a tendency to considerably dictate your own DTI ratio. Within the next parts I’m able to break down how to be considered to own a mortgage for both tips.

Buying A house While using the A pay off Technique for Your Student education loans

You can feel to pay for even more domestic. Sadly, their bank wouldn’t bring your feelings into account. Most of the they love elitecashadvance.com lines of credit is exactly what the newest numbers are… let us figure out how to manipulate your number. One way to help make your numbers look finest is always to reduce your required payment per month in your student loan.

You can do this using the extended important fees bundle on the Federal money. Using more than procedures usually lower your needed monthly payment due to the fact you are repaying the loans more than a longer time of day. Note: Utilizing the offered simple payment plan for Federal Finance would give the exact same interest.

Using the same example in the earlier area, extending most of the finance in order to 25 years while keeping the same interest rate create slow down the complete needed percentage away from $1,632 down seriously to $962. The latest DTI ratio perform up coming become 16% ($962/$5,833), which have 30% available to safe a home loan.

Everything else becoming equivalent, our very own latest graduate do now qualify for a home loan of $315,000. You to most thing you can do are re-finance your own highest focus rates loans on an effective 20 year personal financing to save money and you may drop your own required percentage further. For those who have private money, you can test refinancing him or her toward a lengthier term (If you’d like assist refinancing your college loans, glance at our very own our free education loan re-finance service).

Simply speaking, the more your decrease your requisite payment per month in your college student loans, the simpler it is to qualify for home financing plus the a lot more you can qualify for!

Not so great news, Good news

Something to recall regarding extending financing are could cause to make costs for some time-go out. Hence, you get paying significantly more full as a result of the longer term. That’s the bad news. In order to combat which, it is vital to generate a strategy the place you make extra prepayments. This should help you pay-off your loans faster and shell out less interest.

To buy A house While using the A loan Forgiveness Technique for Their College loans

Earliest things earliest, the government categorizes earnings-founded installment arrangements (IBR), spend because you earn (PAYE), revised shell out because you earn (REPAYE), and you will public-service mortgage forgiveness (PSLF) because the loan forgiveness arrangements. Thus, these represent the measures I am revealing in this area. There are some important factors you have to know ahead of plunge deeper:

- You have to know how Income-Driven Repayment agreements performs. Listed below are some all of our IDR Guide to get a better comprehension of these types of arrangements.